By Dennis Crowley & David Isherwood

Estimated Read Time 3-4 minutes

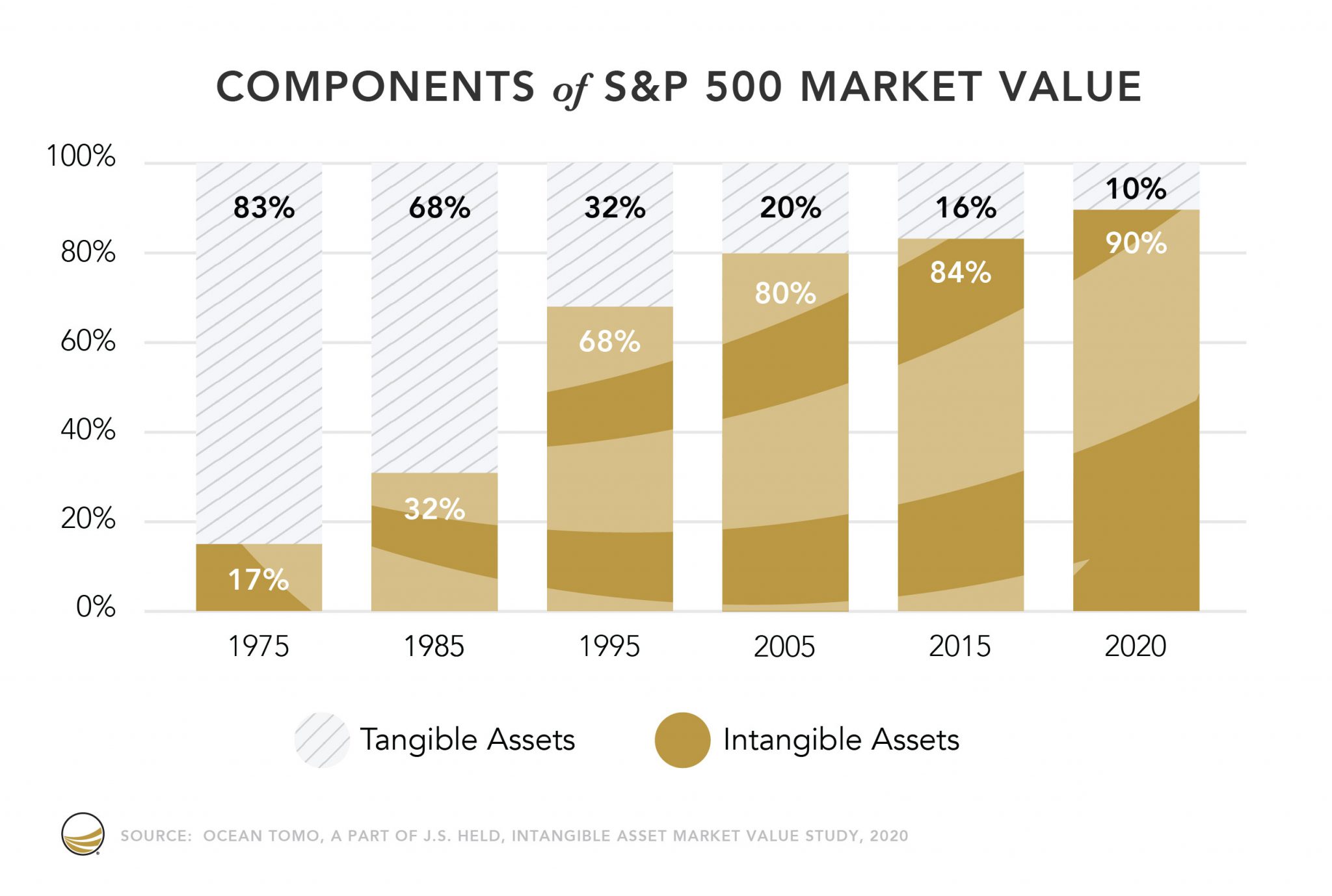

In the intricate dance of business valuation, there are two distinct categories of assets that take center stage – tangible and intangible. Tangible assets, those that can be seen and touched, often occupy the limelight, but it’s the intangible assets that wield significant influence over a company’s true value. Astonishingly, research has shown that nearly 80% of a business’s value resides in its intangible assets, a fact that tends to elude many business owners fixated on the more apparent 20% held by tangible assets.

This isn’t a new trend, but one that has been growing over the past 50 years. With the development of personal computers and software going back to the 1970s, the landscape has changed for nearly all businesses in where their real value lies. It was interesting to read, in a report from WilliamBuck about the manufacturing industry, one where you would expect to find more value in the tangible assets, they state,

“An analysis of the enterprise value of businesses less their tangible asset value, across a vast array of industries (except for investment and banking entities) reveals that 80% of the real value of a business is held with intangible assets such as acquired goodwill, brand names, trademarks, customer lists and the like, as opposed to tangible assets.”

The 80% number has become the standard over the past 20 years for the US market, but a recent study from Ocean Tomo, looking at the impact of COVID-19 on business valuation for the market cap of the S&P 500 pushed that number to 90%. The study also noted the growing trends for increased intangible asset value in Europe and Asia.

As we explore this growing trend, particularly in the post-COVID-19 world, we wanted to traverse the terrain of both asset types, highlighting their nuances and unraveling the strategies that can unlock the hidden potential within intangible assets.

Tangible Assets: The Tip of the Iceberg

Tangible assets are the concrete elements of a business that are visible, measurable, and can be physically possessed. They encompass property, equipment, inventory, and cash—something in a finite monetary value and usually a physical form. These assets play a crucial role in a company’s day-to-day operations, providing the foundation upon which business activities are built. For instance, the machinery in a manufacturing facility, the office building, and even the cash in hand are tangible assets. While they are unquestionably valuable, focusing solely on them can obscure the immense potential that intangible assets hold.

Intangible Assets: The Unseen Force Below the Water

In a knowledge-driven era, intangible assets have surged in significance. These assets often lack a physical form, yet they exert a powerful influence on a company’s competitive edge, reputation, and overall market value. Intangible assets encompass various components, such as intellectual property (patents, trademarks, copyrights), brand equity, customer relationships, proprietary technology, and strategic partnerships. They are the driving force behind a company’s growth trajectory, capable of shaping market perceptions and fostering loyalty. It’s the value found in customer loyalty, brand recognition, and innovative business processes that constitute the intangible assets that define a business’s true worth.

Growing the Value of Intangible Assets: Strategies for Success

While the concept of intangible assets might seem elusive, nurturing their growth and maximizing their value isn’t a mystery. Here are key strategies to consider:

- Invest in Brand Building: A strong brand holds the potential to set your business apart from competitors. Invest in brand development to create a distinct identity that resonates with customers, cultivating loyalty and fostering lasting relationships. According to the Harvard Business Review, a powerful brand can contribute to as much as 25% of a company’s market value.

- Harness the Power of Innovation: Innovation is a driving force behind intangible asset growth. Developing cutting-edge technology, unique business processes and patents can create a competitive edge that’s hard to replicate. Forbes emphasizes the significance of innovation as a tool to enhance intangible asset value.

- Foster Customer Relationships: Loyal customers are invaluable intangible assets. Cultivate lasting connections through exceptional customer service, personalized experiences, and engagement. Customer loyalty has a significant impact on a company’s revenue growth. In fact, loyal customers can be one of the most valuable assets a company has, as they tend to spend more money and make more frequent purchases.

- Nurture Intellectual Property: Protect and leverage your intellectual property, whether it’s patents, trademarks, or copyrights. Forbes underscores the role of intellectual property in shaping a company’s intangible asset value.

- Develop Strategic Partnerships: Form alliances that provide unique advantages, such as exclusive contracts or collaborative ventures. These partnerships can enhance your market position and contribute to intangible asset growth. The Harvard Business Review highlights the value of strategic alliances in driving business success.

Intangible assets hold the key to unlocking a business’s true potential and value. While tangible assets play a foundational role, it’s the intangible assets that often elevate a business from good to exceptional. Recognizing their significance and strategically nurturing their growth can result in a substantial impact on a company’s market value, enhancing its attractiveness to potential investors and buyers alike.

In today’s business landscape, understanding the value of intangible assets is an essential step toward long-term success. As partners in your business journey, Planned Value Group offers strategic insights and guidance to help you optimize the potential of your intangible assets. Discover the power of intangibles and embark on a path of growth, innovation, and increased market value.